Escaping the Pitfalls of Awareness Measurement

Across our diverse portfolio of clients, awareness tends to be the most valued metric of any brand tracking study. After all, who doesn’t want to be recognized as a leader in their category? Still, when you consider the other valuable metrics of the studies we conduct (Brand Perceptions, NPS Scores, etc.), why does awareness hold such sway for clients and strategy efforts?

One reason for this is the fact that awareness converts. As you move down the funnel, there are harder conversion metrics (for instance, consideration, purchase and loyalty), but a customer’s awareness of a brand is an antecedent to their willingness and likeliness to buy. There’s no doubt awareness matters, and yet we’ve seen many clients struggle to define success in growing awareness. Here, we’ll outline four ways to make awareness count.

Tip #1: DO NOT pretend that awareness exists in a vacuum

If you over-focus on growing awareness for the sake of itself, you could potentially create unrealistic expectations for the ROI of those awareness gains. However, with sound assumptions of how awareness gains will flow through the funnel, we can arrive at a reasonable ballpark estimate of the sales impact and ROI of awareness gains. We can do this by leveraging the “aware-to-purchase ratio” — the percent aware divided by the percent who purchase. You can use this statistic with a top-down approach, testing levels of awareness gains and estimating the impact on lower funnel sales, or with a bottoms-up approach, estimating the required awareness gains to meet your sales goal. Take for example our experience with an awareness-focused client, who had set a fairly lofty goal of +5-15% awareness over a one-year time period. We found that reaching their lower end goal would yield an estimated sales lift of 10% and a projected ROI of ~$4, and the upper end an eye-popping 40% sales lift and ~$12 ROI. Simply put, it helps to work backward from sales goals toward awareness goals — no matter what, good strategy connects all the dots.

Tip #2: DO NOT be myopic in selecting an awareness measure

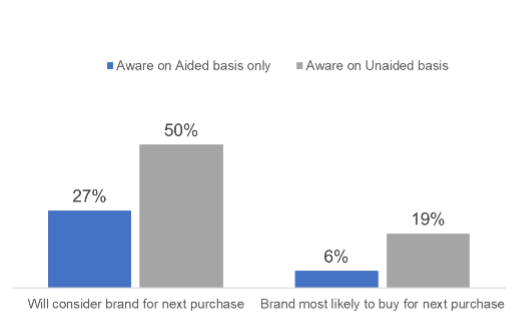

More often than not, we see brands focused on aided awareness (wherein customers or survey participants are asked to select from a provided list of brands) instead of unaided awareness (no list of brands provided). There are a few reasons for this, but most of the time it comes down to the simple fact that the aided awareness number is larger. A brand might have 8% unaided awareness but 55% aided awareness, and marketers aren’t keen to consider the idea that their considerable advertising spend may be yielding them awareness in the single digits. But here’s the rub — unaided awareness is often more responsive to marketing activity, and purchase conversion is more likely among consumers who are aware on an unaided basis. Take, for example, our experience with one of our brand-tracking clients. As the chart below shows, the percentage of respondents who say they are likely to consider the brand and, ultimately, purchase the brand among those aware on an unaided basis is substantially higher than those only aware on an aided basis. While the direction of this result may not be surprising, the scale of the difference in positive outcomes for the brand is considerable.

Tip #3: DO NOT defy the laws of statistical significance

Here’s some low-hanging fruit: use the upper bound of statistical significance to help set your goal. For instance, if your study has a margin of error of 5%, then setting a goal of 3% is basically the same as setting it at 0%; if your study has a margin of error of 2%, setting a goal of 5% may be too lofty, at least for your lower end goal. Though we always caution our clients not to let statistical significance become a crutch, it’s worthwhile to mine the data for relevant trends. In the event you’ve already achieved a baseline awareness level, use the appropriate statistical formula to calculate the upper and lower bounds of the 90% or 95% confidence interval. If you do not yet have a baseline, use 50% as the most conservative estimate (because that is the point in the distribution that will require the largest increase to register as significant) and include a table with confidence intervals by n size.

Tip #4: DO NOT get emotional over minor fluctuations

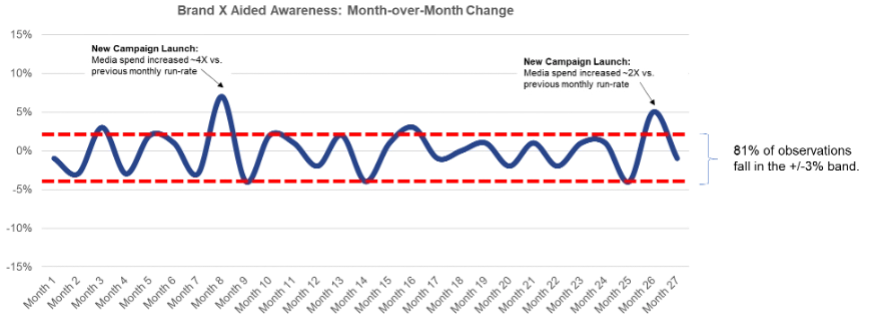

Marketers often over-react to any slight uptick (positive!) or pullback (negative!) in a given period. However, awareness gains, particularly in the case of aided awareness, tend to be a slow build. This is where historical trends can be a particularly helpful guide for awareness expectations. If you have a time series of awareness data for your brand, plot quarter-over-quarter or month-over-month differences by period for your brand and competitors, and you’ll quickly be able to see normal ebbs and flows and calculate the percentage of observations that fall within a particular band. On this point, our experience with the client noted above is instructive. The chart below shows the month-over-month changes in aided awareness over 27 months. In doing this, we see that the only two true signals of awareness change aligned to periods of new marketing campaigns with elevated levels of media behind them.

Awareness matters because it converts, earning its reputation as a most-prized brand health tracking metric. How we set awareness goals and measure it as marketers matters just as much. We don’t want to “sandbag” our goals leaving potential growth on the table, nor do we want to “shoot ourselves in the foot” by setting lofty expectations. Hopefully, with these tips you can avoid common pitfalls of measuring awareness.

This is not an advertisement, and solely reflects the views and opinions of the author. This website and its commentaries are not designed to provide legal or other advice and you should not take, or refrain from taking, action based on its content.